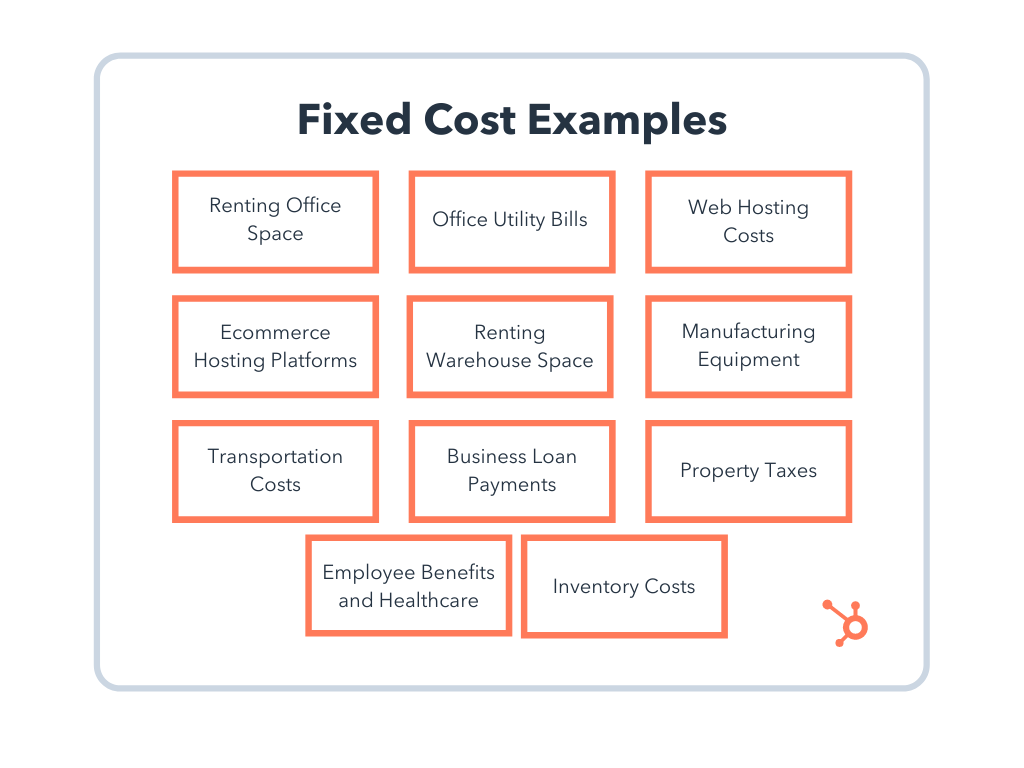

At the same time, the employee might receive a sales commission directly tied to production, making it variable. However, this is unrelated to how many units were produced. For example, an employee might receive a raise in their salary after an annual review. While fixed costs do change over a long-term period, this change isn’t related to production. Examples of fixed costs include:Īn employee’s salary would be considered a fixed cost, while sales commissions are variable.

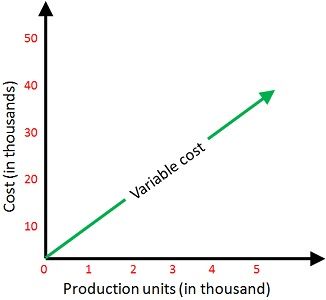

Whether or not you make sales, you’ll still need to pay the same fixed costs. Fixed costs remain the same no matter how much (or little) you’re producing. To better understand the answer to ‘what is variable cost’, it’s helpful to compare it to the other type of expense – fixed costs. In accounting, variable costs are looked at through a short-term lens because you can adjust them quickly by shifting production levels. For example, the amount your business spends on raw materials is variable, because it will fluctuate depending on your production needs. They rise along with production increases and fall when there’s a decrease in production. In other words, if your business produces more units, variable costs will also increase. A variable cost is any business expense that changes according to production output. What is variable cost?īusiness expenses are broken up into two main categories: fixed and variable. But what are variable costs and how do they compare to fixed expenses? Find out more about what qualifies as ‘variable’ below.

Variable cost meaning how to#

To accurately forecast corporate expenses, you need to learn how to calculate variable costs.

0 kommentar(er)

0 kommentar(er)